Recently, there’s been a new rule implemented that mandates every elected official in our city, including City Commissioners like myself, to publicly disclose our tax returns and business dealings. As someone who has always been an advocate for transparency, I wholeheartedly support this move. Transparency, after all, is the bedrock of a strong democracy, and this initiative can only deepen the trust between elected officials and you, our valued constituents.

While the idea of sharing personal financial data might seem daunting to some, I believe that when we step into the world of public service, we have a responsibility to lead with integrity and openness. The essence of this new rule is to ensure that there’s no conflict of interest and that we, as public representatives, prioritize the welfare of our community above everything else.

In my tenure as your City Commissioner, I’ve seen firsthand the transformative power of transparency. It encourages greater community engagement, instills confidence, and most importantly, holds us accountable for our actions. By openly disclosing our tax returns and business interests, we’re taking a collective pledge to maintain the high standards of honesty and integrity that you, the residents of Winter Springs, expect and deserve.

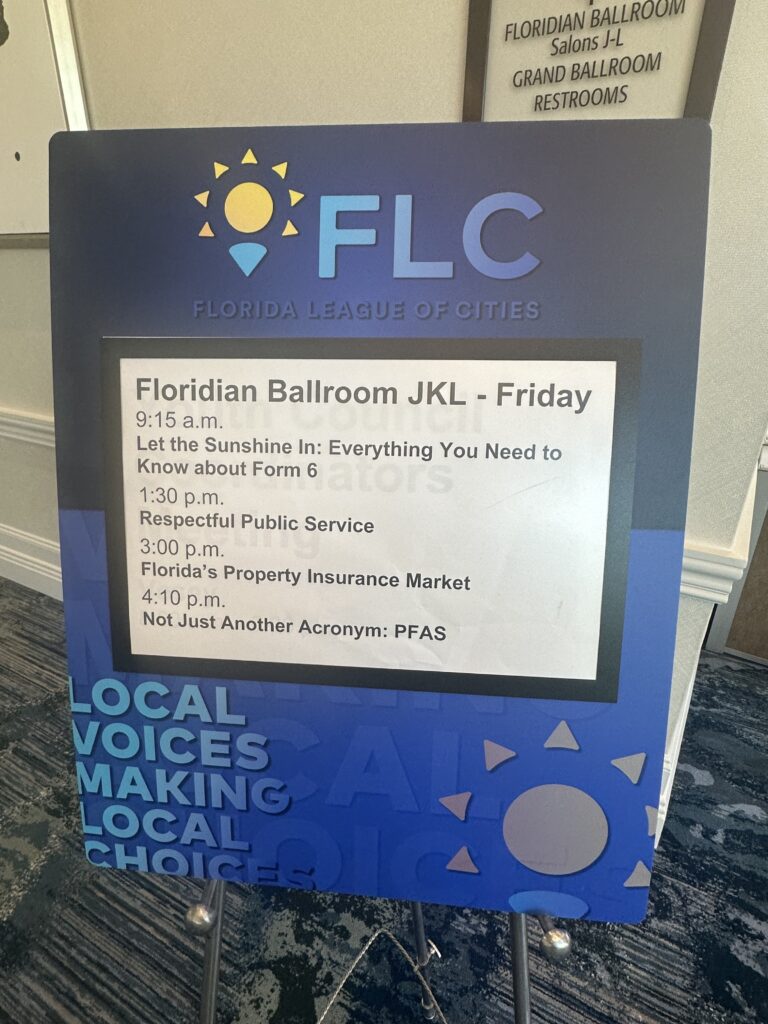

The new law mandates that local elected officials no longer file the previously known Form 1 financial disclosure. Instead, they must file “Form 6—Full and Public Disclosure of Financial Interest” with the Florida Commission on Ethics by July 1 of each year.

Form 6 is considerably more comprehensive than Form 1 and it mandates officials to:

- Report each source of income over $1,000, its address, and the total amount received.

- Identify and value assets exceeding $1,000.

- List the creditor’s name and address for liabilities over $1,000 and specify their amounts.

- Present a statement indicating the value of one’s net worth as of December 31 of the preceding year, or a more recent date.

Disclosure Options:

To satisfy the first requirement, officials have two options:

- Provide a sworn statement detailing each income source and amount over $1,000.

- Share the most recent federal income tax return, including all its associated attachments and schedules.

I want to take this opportunity to share that I am currently in the process of gathering all the necessary documents and will be completing my disclosure at the earliest. I urge my fellow commissioners and elected officials to do the same promptly. It’s not just about compliance; it’s about taking a stand for transparency and ensuring that the interests of our community always come first.

I understand that change, especially one of this nature, may lead to numerous questions and perhaps a few concerns. I invite you to reach out with any queries you might have. As always, I am here to listen, clarify, and act in the best interest of our beloved Winter Springs.

In conclusion, the path to a better and more transparent governance system is paved with such initiatives. Let us all embrace this change and ensure that Winter Springs remains a beacon of trust, community spirit, and forward-thinking governance.

By Kathleen Nucci

Thank you. Who do you support in the upcoming election? Local and County.

Thanks again for watching out for your constituents.